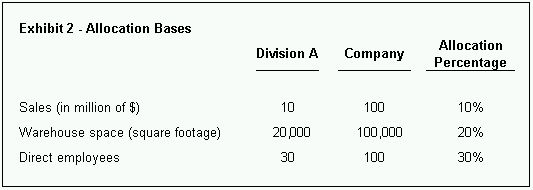

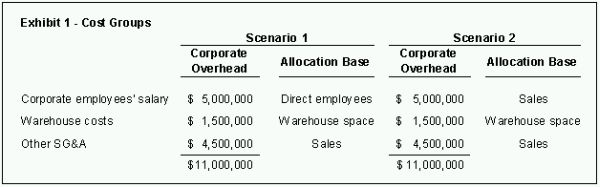

Allocation Of Fixed Overhead Costs: Significant Impact On Value - Corporate and Company Law - Canada

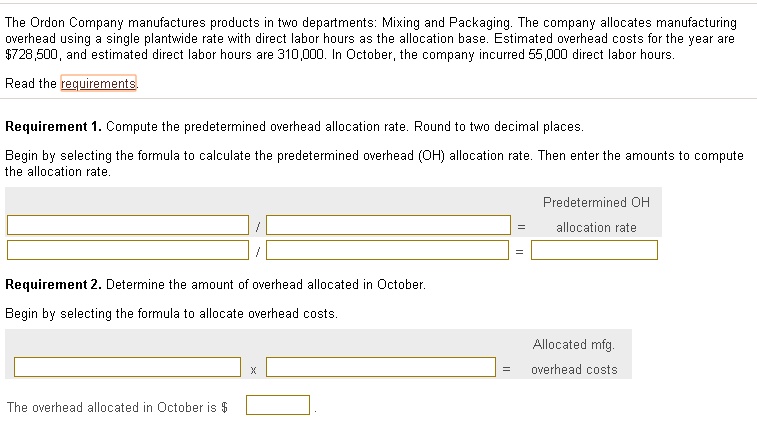

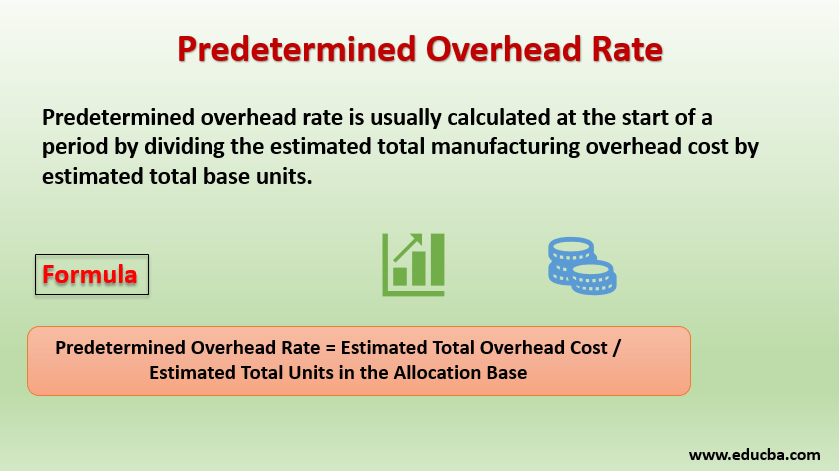

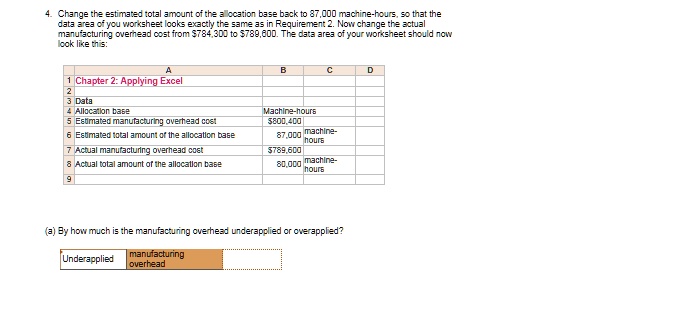

SOLVED: 4. Change the estimated total amount of the allocation base back to 87,000 machine-hours, so that the data area of you worksheet looks exactly the same as in Requirement 2. Now

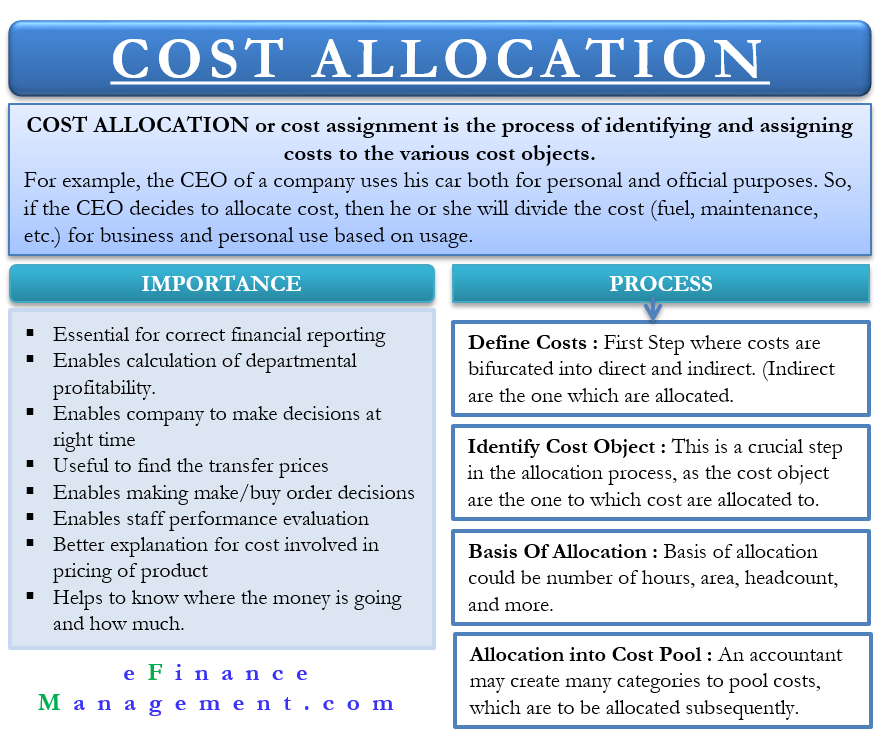

Allocation Of Fixed Overhead Costs: Significant Impact On Value - Corporate and Company Law - Canada

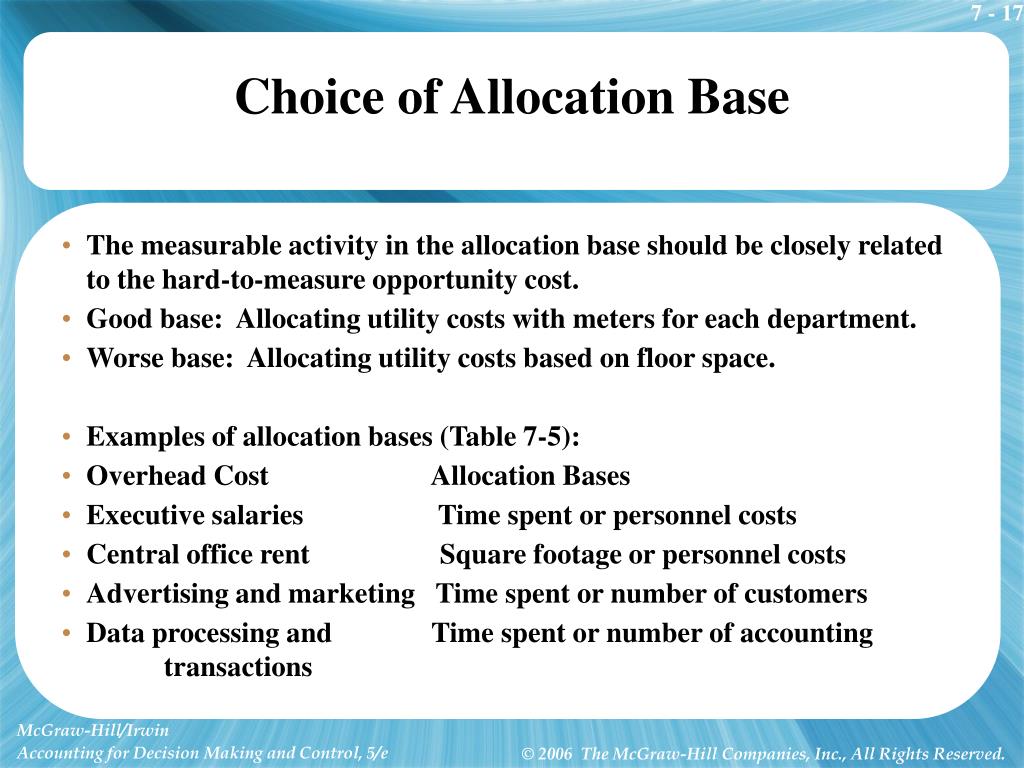

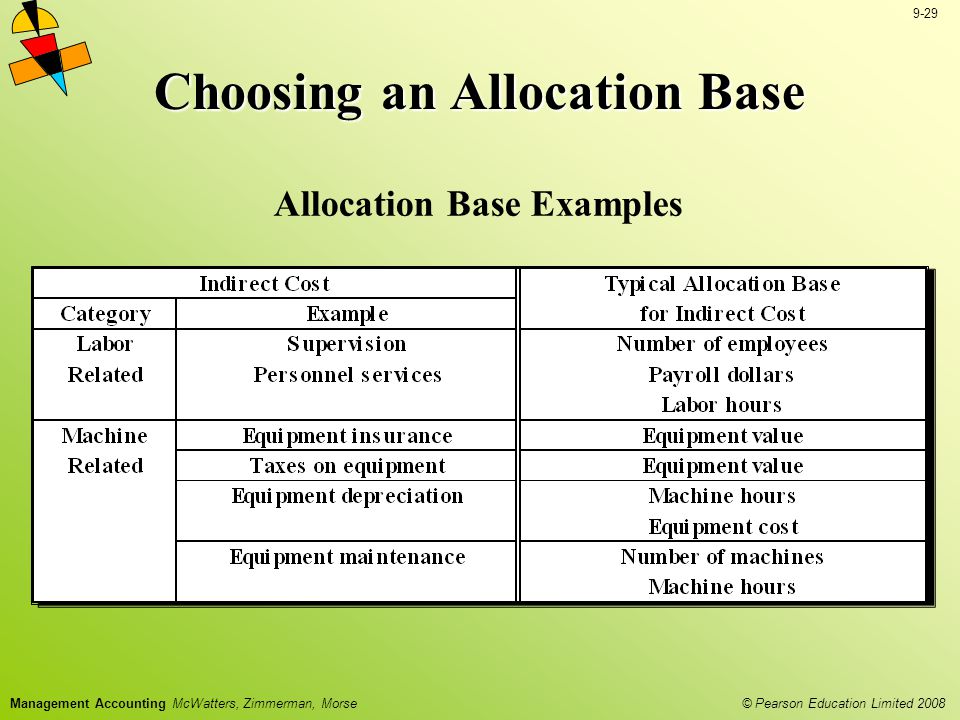

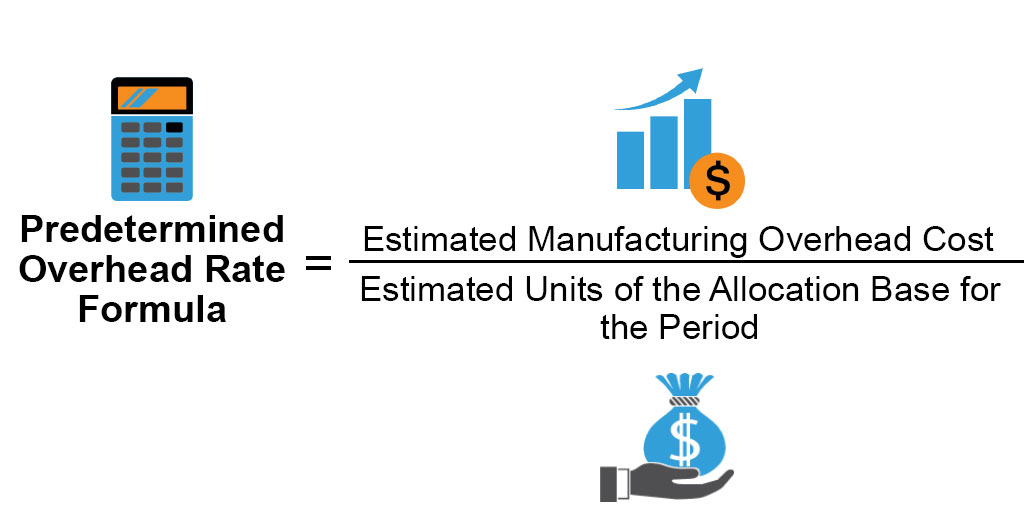

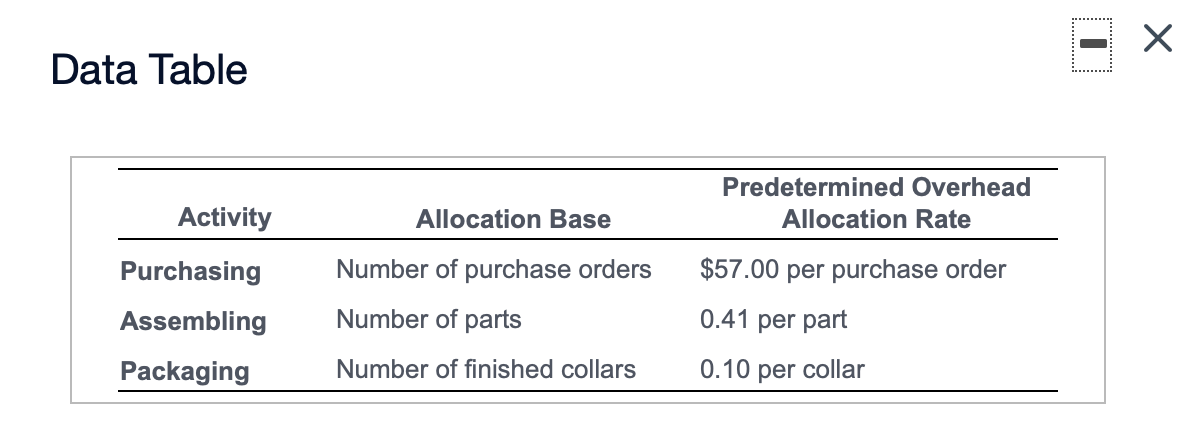

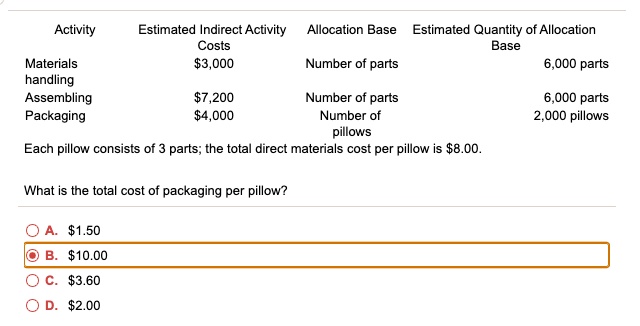

SOLVED: Activity Estimated Indirect Activity Costs 3,000 Allocation Base Estimated Quantity of Allocation Base Number of parts 6.000 parts Materials handling Assembling Packaging7,200 4,000 Number of parts Number of pillows 6,000 parts