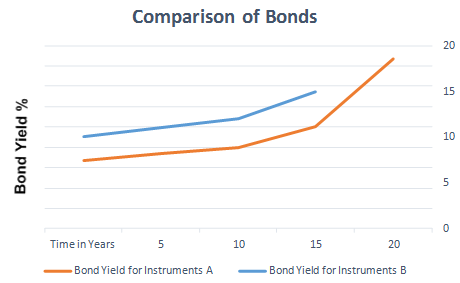

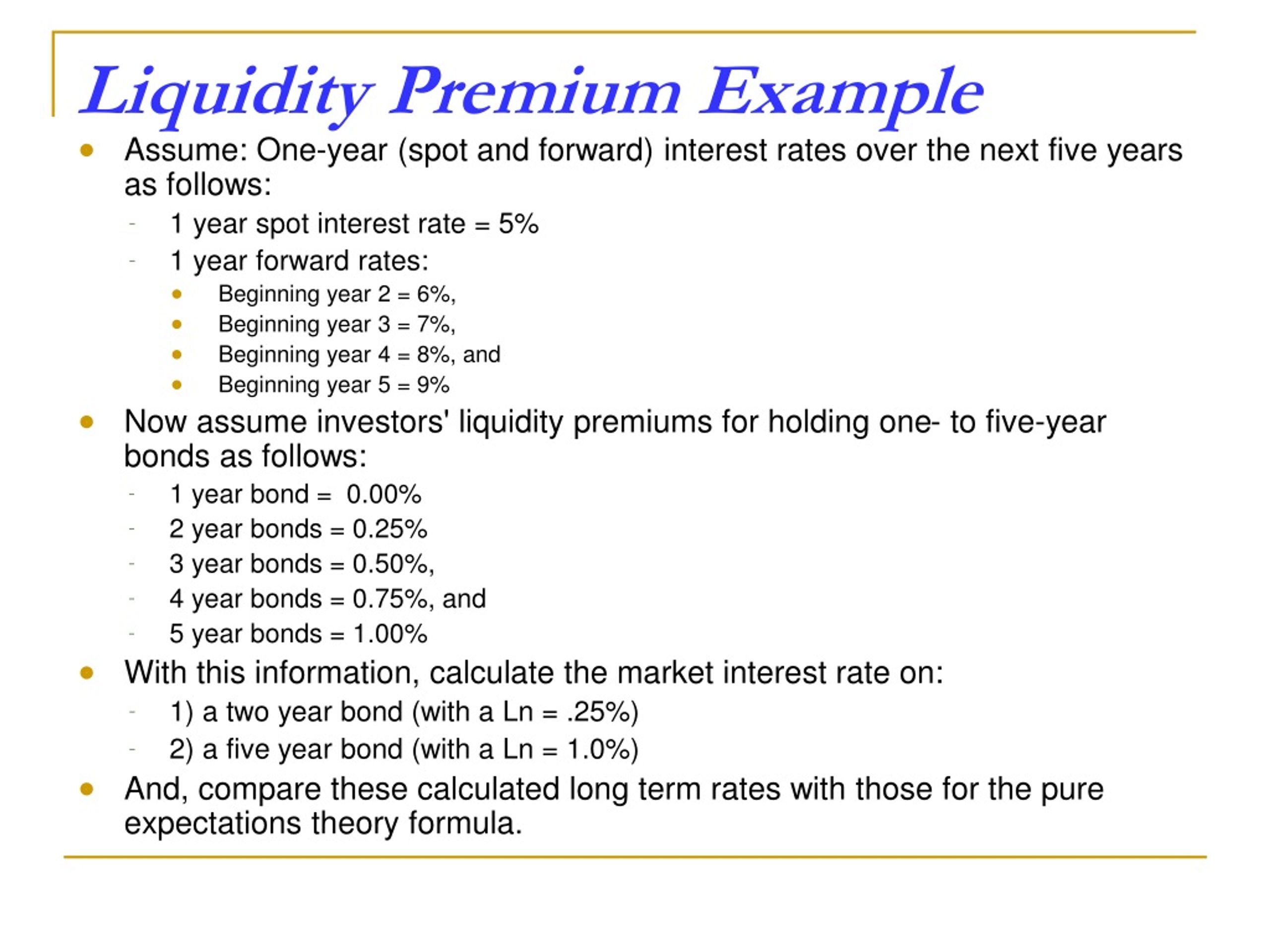

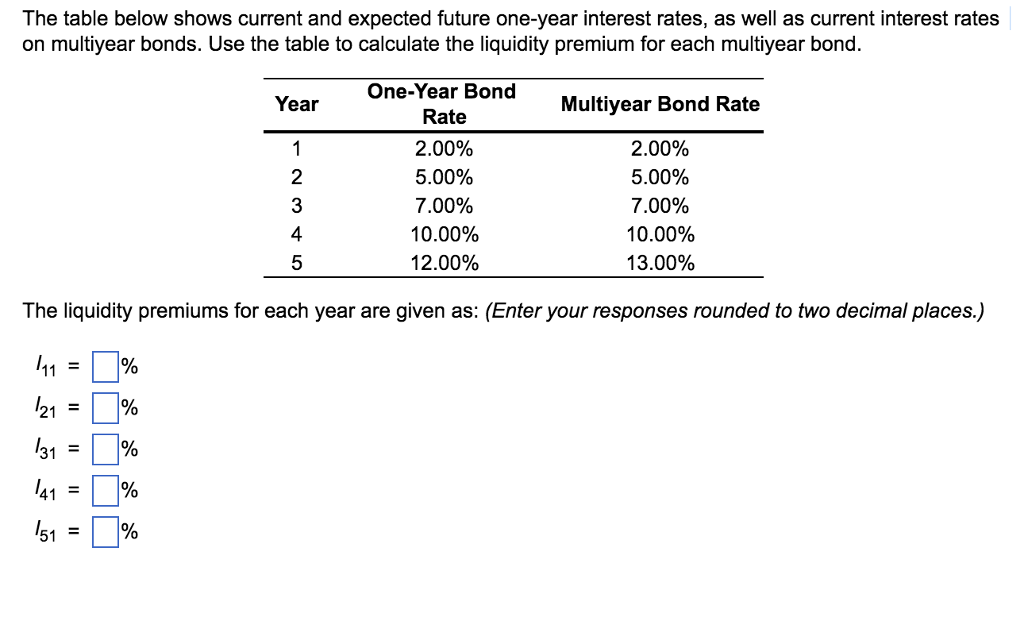

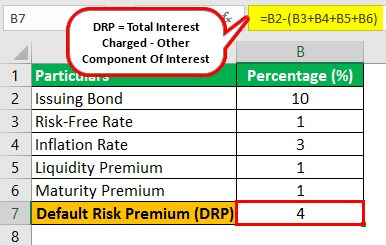

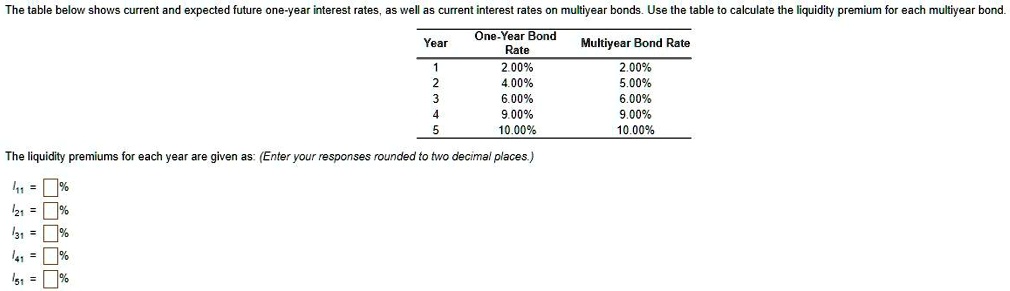

SOLVED: The table below shows current and expected future one-year interest rates, as well as current interest rates on multiyear bonds. Use the table to calculate the liquidity premium for each multiyear

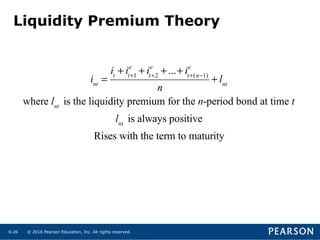

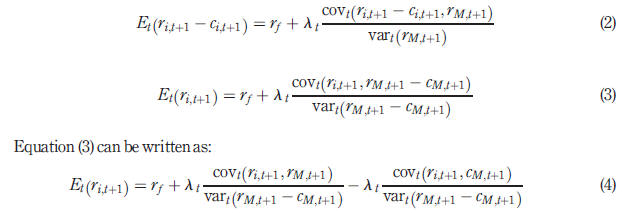

SOLVED: 1.(15) Over the next three years, the expected path of 1-year interest rates is 4, 1 and 1 percent. The liquidity premiums for the one year rate are 0%, 1.0% and

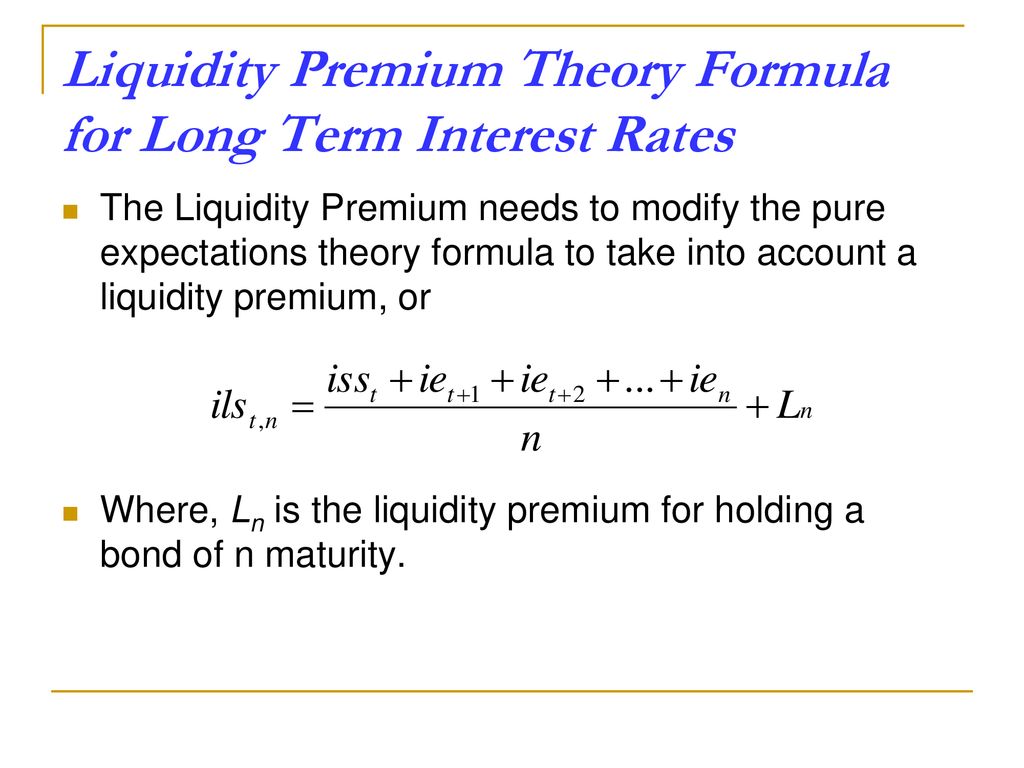

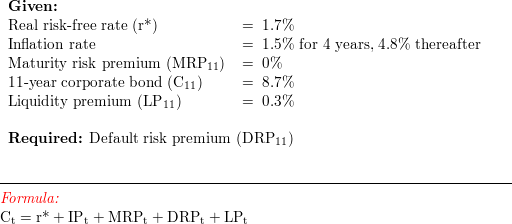

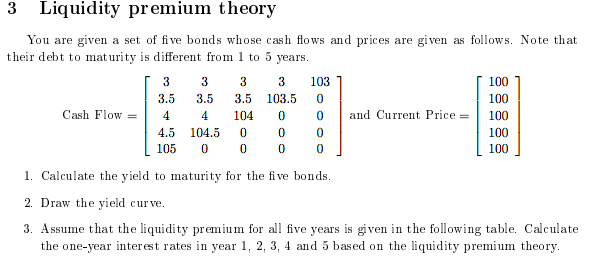

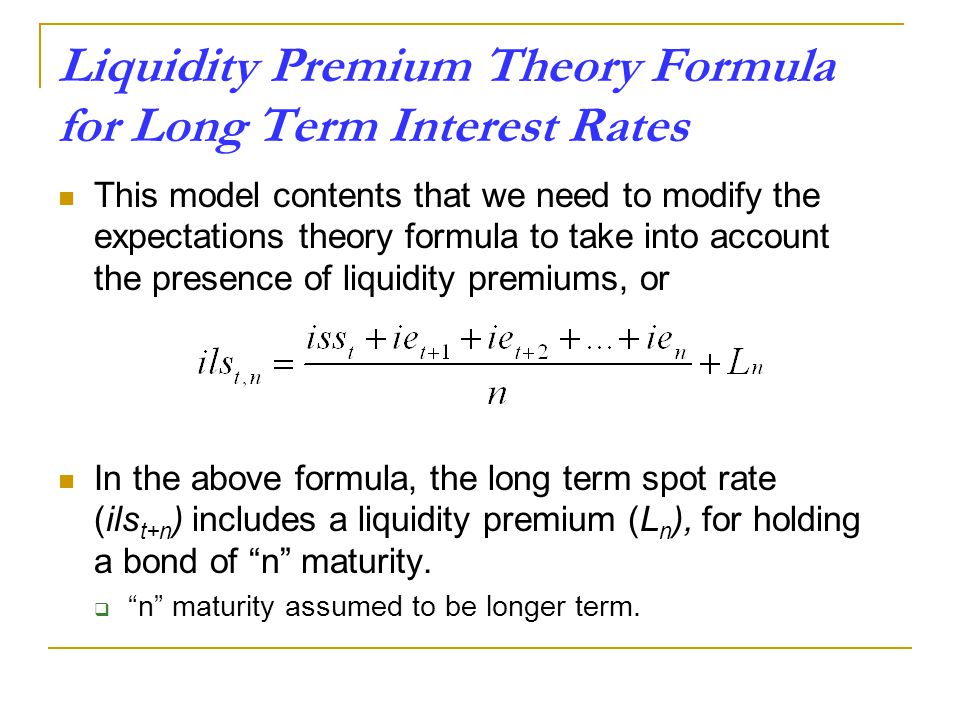

TUTO 5.2 - TERM STRUCTURE OF INVESTMENT TUTORIAL - 1. Dec 2019 Question 3 b) With the aid of - Studocu

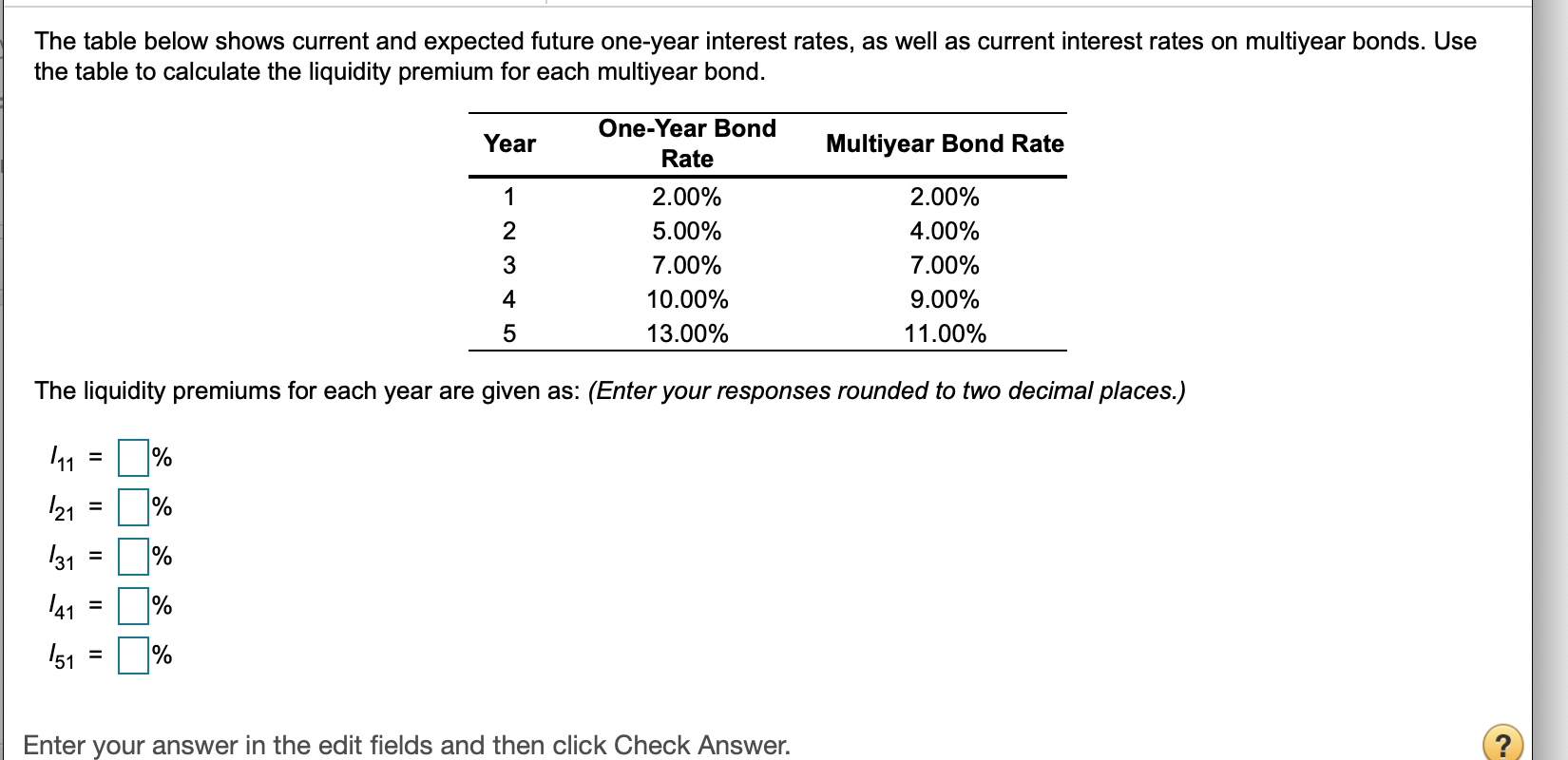

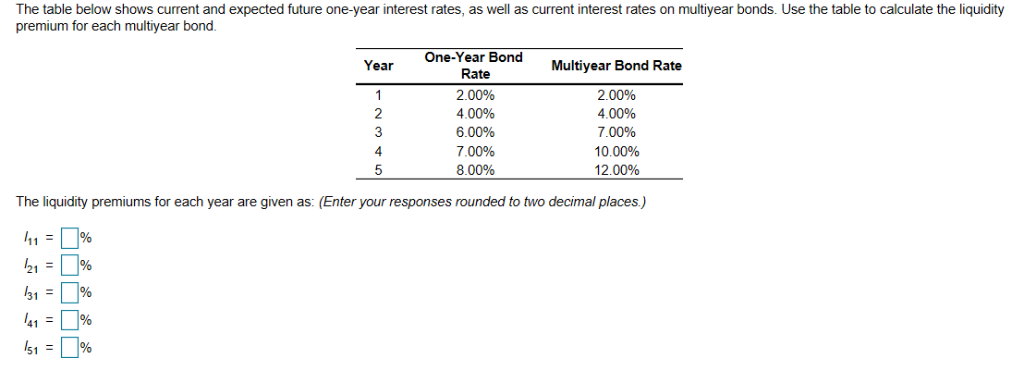

SOLVED: The table below shows current and expected future one-year interest rates, as well as current interest rates on multiyear bonds. Use the table to calculate the liquidity premium for each multiyear

Liquidity premium for different combinations of drift and investment... | Download Scientific Diagram