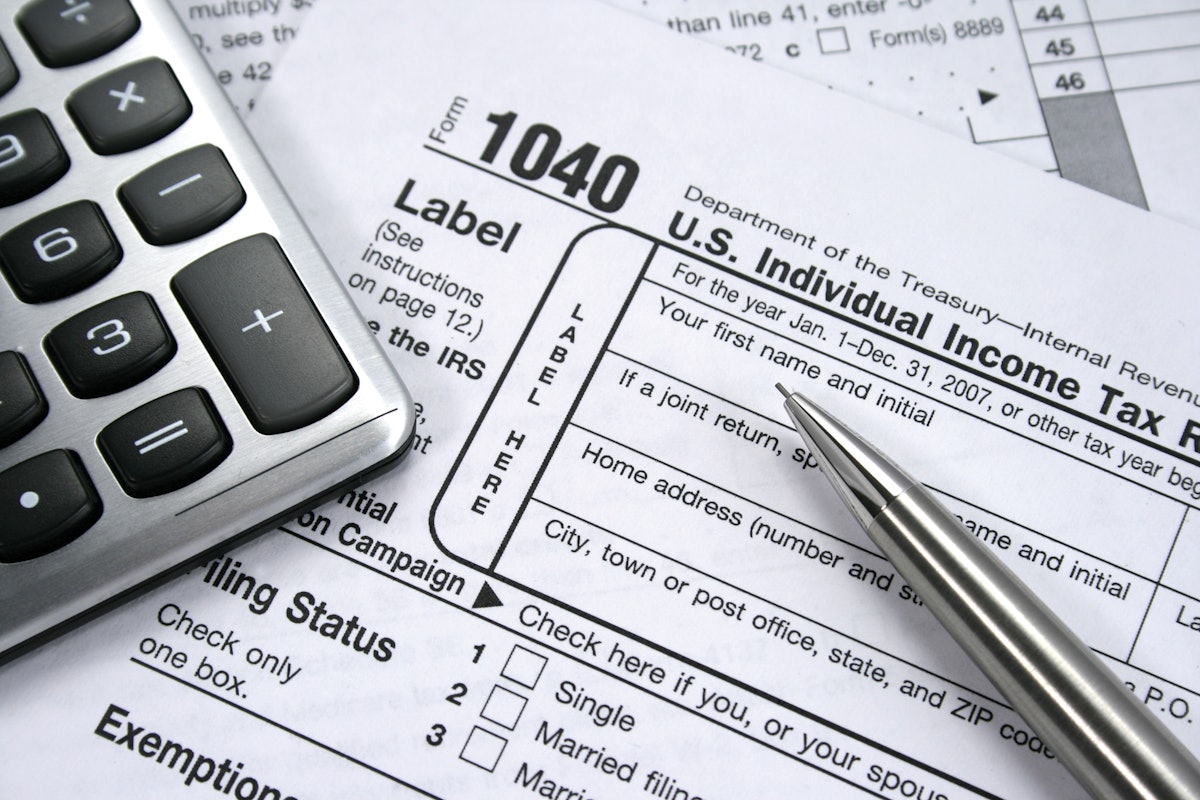

1040 individual income tax return forms, W-2 wage statement and calculator. Concept of income taxes and federal tax information - Beaver County Radio

eSmart Payroll Tax Software Filing - efile form 1099 MISC 1099C W2 W2C 940 941 DE9C, e-file corrections

W-2 Tax Form With Calculator, Pen & Twenty Dollar Bill High Quality Stock Photo Stock Photo | Adobe Stock

W2 Tax Form With Calculator Twenty Dollar Bill Stock Photo - Download Image Now - Tax Form, Growth, Tax - iStock

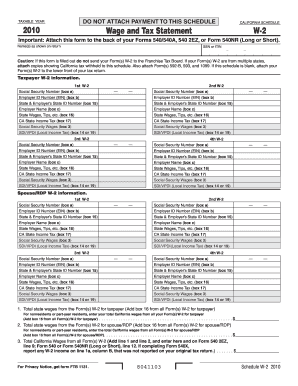

62 Printable Income Tax Calculator Forms and Templates - Fillable Samples in PDF, Word to Download - Page 2 | pdfFiller